Lessons Learned from Implementing Universal Allocations in SAP S/4HANA

Authored by Sangeetha Macharla, SAP finance consultant, TruQua, an IBM Company and Shubha Mhaskar, finance transformation practitioner

As organizations look to simplify period-end allocations within SAP S/4HANA, many project teams are leveraging universal allocations as a primary solution to streamlining these processes. And recent improvements in universal allocations have made these processes even easier for teams to implement.

In this blog, we’ll share our best practices for implementing universal allocations based on recent client use cases as well as share our functionality “wish list” that we’d like to see added to future roadmaps.

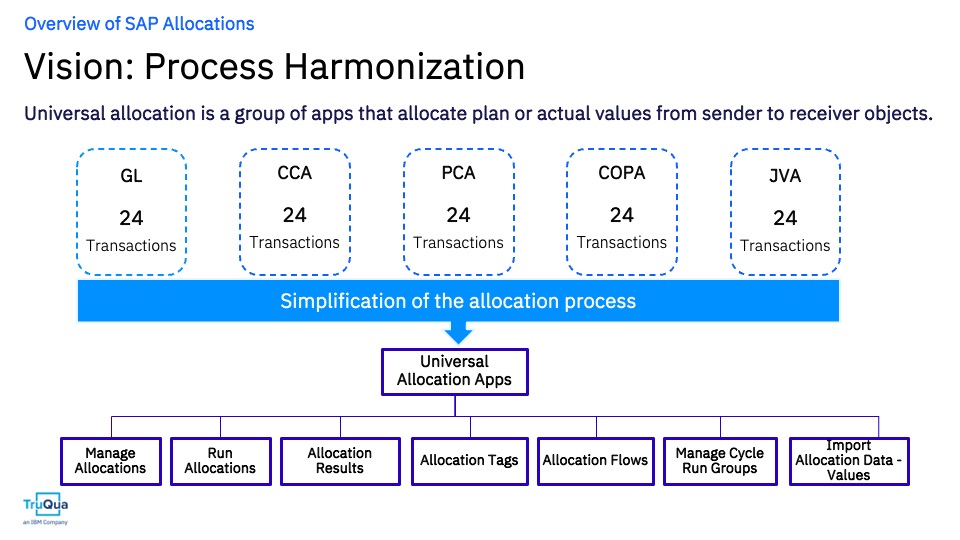

SAP’s vision of universal allocation is mainly based on simplification of allocation processes for better usability and result traceability. SAP’s motivation behind universal allocation is to deliver a comprehensive solution covering various facets of classic allocation processes with a primary focus on the below aspects:

- Cohesive solution that has out-of-box integration with universal journal

- Comprehensive functionality with various types of allocations under one umbrella

- Simplified execution framework with better usability and result traceability

In SAP ECC, allocations must be maintained and executed using various transaction codes depending on the context (cost and profit center assessments of overhead costs, top-down distributions to profitability segments for profitability analysis, intercompany allocations, etc.). Universal allocation in S/4HANA delivers better user experience via a set of Fiori applications that cover various allocation contexts for both actual and plan data. The visual below provides a quick refresher of the current scope (as of SAP S/4 HANA 2023) of universal allocations.

Figure 1: Current scope (SAP S/4HANA 2023) universal allocations

For details on SAP’s vision and scope of universal allocations and the delivered functionality, please refer to key concepts of universal allocations on SAP’s help portal.

Use Case: Business Requirements

Based on SAP’s direction of the single allocation model and execution framework in S/4HANA, universal allocation was chosen as a solution for our clients’ use cases around segment allocations and departmental cross-charge allocations.

By understanding the intricacies of our clients’ use cases, we were able to design a tailored solution using universal allocations that met our client’s specific needs. It is important to note that in this use case, segment allocations turned out as profit center allocations and cost center allocations depending on the section of trial balance as segments align with profit center master data. Cross-charge allocations were pretty much cost center allocations on various expense sections of the income statement.

Creative Solutions for the Challenges we Faced

During the process of implementing the allocation use cases, we came across a few challenges when setting up the allocations as well as with the execution. Listed below are the main challenges we came cross and creative solutions we came up with to overcome these technical and practical challenges.

Design Challenges

One of the first hurdles we faced was in addressing the business requirement to retain values posted to certain additional fields into the allocation results. The intent of segment allocation is to allocate common expense pools across reporting segments of the company. An additional requirement that came from business was to retain certain attributes of the original posting during the allocation and cascade down into the results posted by the allocations. This was important based on the client’s FP&A’s reporting requirements.

The silent inheritance feature had worked its magic for the most part to address this challenge. However, it drove the solution architecture of the universal journal to set up the custom ledger fields as classic coding block fields and then published to S/4HANA using key user extensibility app (custom fields and logic). This type of coding block extension is compatible with the silent inheritance feature of universal allocation and enabled propagation of custom fields from sender to result of the allocation. OSS Note provides technical setup details on how to enable silent inheritance feature in universal allocation.

Another key requirement for our clients was to provide a plant level rule for profit center allocation. At the time of our projects, SAP offered only silent inheritance in universal allocation and any other attempts to change allocation field settings were not supported. From our testing of the universal allocation features, we discovered that some settings for a few standard fields were compatible. The sender/receiver filter on plant for profit center allocation was compatible and that addressed this requirement.

The projects also required that we set up profit center allocations for a few revenue adjustment accounts that were posted to on non-segment specific profit centers. At around the time of the project, SAP released a feature to support profit center allocation for balances on primary cost element (GL account type P) with non-operating expenses/income account (GL account type N) as receiver. This feature enabled profit center allocation of revenue adjustment amounts on non-segment specific profit centers to segment level profit centers.

Another key learning came through leveraging plan categories non-traditionally to gain efficiencies in driver maintenance. Using statistical key figures as an allocation driver is a common method when the allocation is not based on other account balances. Since the profit center allocations in this case needed to use plant-based receiver tracing factors, we defined specific plan categories just for statistical plan data postings for usage as allocation drivers. This resulted in a flexible and user-friendly solution for loading allocation drivers at plant level compared to SKF use.

Run Time Challenges

As universal allocation is optimized with HANA capabilities of in-memory computing and advanced DB level execution of the procedure, SAP allowed larger number of allocation segments (allocation rules) per allocation cycle compared to segment count per cycle supported in ECC. However, there is a run time limit of maximum of 999 as the number of allocation segments that can run together in one allocation run. This required designing allocation cycles and cycle-run groupings around this limitation. We have submitted a request to SAP to explore a potential fix for the runtime limit issue, with the goal of ensuring a smoother and more efficient user experience.

A few other challenges we faced were related to accounting period validity checks for non-leading ledger-based runs for the companies with different fiscal year variant on non-leading ledger compared to that of leading ledger. This was resolved as SAP released correction via OSS Note 3303101.

Our Wishlist of SAP Innovations for the Universal Allocation Engine

Allocation Account Mapping Structure for PC Allocations

Profit center allocations for miscellaneous revenue and COGS accounts (e.g. cash discounts, volume-based rebates) were to be set up as overhead allocations with the receiver being non-operating expense/income accounts (as of SAP S/4 HANA 2023). This resulted in multiple allocation segments, i.e. in proportion to the number of P&L sub-sections.

In the use case above, using plant-level receiver tracing factors resulted in proliferation of allocation segments. While plant-level profit center allocation results in multiple allocation segments, we wish we had a sender-receiver account mapping feature (like allocation structures for cost center allocations) that could have made our PC allocations neater with lesser proliferation of allocation segments.

This recommendation has been submitted as a Customer Influence Item to SAP. Good news, SAP acknowledged it and is considering addressing it in the long term. We are looking forward to this great feature that will benefit many others implementing PC allocations.

Third-Party Scheduler Compatibility

SAP has nice scheduling apps for universal allocations, and we would love to see enhancements to those with dynamic parametrization of period. Also, the job scheduler apps did not fully support the allocations triggered by a third-party scheduler. Fortunately, our client’s job-scheduling team was able to come up with workarounds to address the integration in our case. Third-party scheduling compatibility would be a great improvement for those customers wanting to continue using their enterprise standard job automation software.

Extended Functionality on Custom Fields

It would be beneficial to able to use sender/receiver/receiver tracing settings on custom fields for profit center and cost center allocations as many SAP clients use such functionality in ECC thru GL allocations and special purpose ledger allocations. Extending such functionality to universal allocations will enable those customers to be able to leverage it as a single framework for all the allocations.

Conclusion

SAP’s vision of bringing various allocations under one umbrella of universal allocation provides great process harmonization and value flow visualization to clients on their S/4 implementation journey. While SAP’s roadmap includes further enhancements to universal allocations, the currently available functionality of the single allocation model, harmonized execution framework, and user-friendly applications can be leveraged to design a flexible solution for various allocation use cases.

We are looking forward to improvements and new developments in universal allocations that will enhance the potential of the performance management solution in S/4 HANA.

For those readers who are interested in deep diving into various performance management solutions offered by SAP, we’d like to re-introduce this blog by our TruQua colleague, Marius Berner. In this blog, Marius focuses on the significance of a well-designed performance management strategy along with SAP offered complimentary solutions and decision matrix that provides strategic guidance on determining the right solution(s) for end-to-end performance management.

About the Authors

Sangeetha Macharla is a seasoned SAP finance professional with extensive competency in managerial accounting. With 20 years of experience across various SAP implementation projects, Sangeetha has a deep understanding of the SAP finance and controlling modules and related intricacies. Throughout her career, Sangeetha has played a pivotal role in designing and delivering solutions for managerial accounting in multiple SAP ECC and S/4HANA implementations. She has expertise spanning across various aspects of SAP finance integrations, including general ledger and profitability/margin analysis across many industries including pharmaceuticals, banking, and consumer packaged goods. Sangeetha also has extensive experience in architecting and delivering solutions for performance management using SAP PaPM.

Shubha Mhaskar is a finance and data-driven CPA with over 20 years of experience leading and managing large-scale finance transformation and reporting & data analytics projects using SAP technologies. She has extensive expertise in architecting and designing high-quality and sustainable solutions with SAP S/4HANA, SAP Central Finance, SAP FIORI, SAP ERP, and SAP Business Intelligence. Through her professional engagements, Shubha has developed deep expertise in SAP Finance and controlling modules, with a strong understanding of complexities and integration in managerial accounting focusing on product costing and profitability/margin analysis. Additionally, Shubha possesses extensive knowledge and experience in data analytics, business warehousing, and big data technologies.