BlackLine Account Reconciliation and the Universal Journal: Helping companies comply with Audit Standards

By Imran Lodhi, VP, BlackLine Practice at TruQua

Customers who are moving to SAP S/4HANA frequently seek to clarify and question the value of BlackLine’s Account Reconciliation tool in the advent of the Universal Journal.

To better understand BlackLine’s position with S/4HANA, we first need to consider the Universal Journal’s reconciliation scope and how BlackLine complements SAP’s functionality.

SAP S/4HANA Universal Journal

Before SAP S/4HANA, the sub-ledgers in FI/CO (Finance and Controlling) were housed within separate tables. For financial reporting purposes, the data between these tables had to be tied out to remove data redundancies, duplicated line items, etc.

The Universal Journal has brought this data together, eliminating the non-value-add, manual work which accounting teams had previously performed. The removal of these tasks allows for business users to make faster business decisions based on a more holistic view of both financial and management accounting as well as accelerate their period closing activities.

How does BlackLine’s Account Reconciliation Tool Compliment the Universal Journal

Organizational management is responsible for ensuring that the financial statements they present are materially correct.

To help companies meet this responsibility, the PCAOB in the US, for example, sets out a framework of Financial Statement Assertions to categorize and set expectations:

- Existence or occurrence – did the assets or liabilities exist and recorded transactions occur in the reported period?

- Completeness – has everything been included which needs to be reported?

- Valuation and allocation – have transactions been presented in the correct class and at the right amount?

- Rights and Obligations – are assets and liabilities truly owned or obligated, respectively?

- Presentation and Disclosure – have financial statements presentation requirements been met?

“Accounting Reconciliations” are a key tool used to providing evidence for meeting the above assertions.

The Universal Journal contributes to important elements of the Completeness and Valuation assertions, however, there are sub-ledgers outside of the SAP landscape and other assertions to consider and this is where BlackLine can help.

Blackline has differentiated itself as the best in class Account Reconciliation tool (Gartner Magic Quadrant) and as a Solutions Extension (SolEx), SAP has recognized how BlackLine extends the functionality of its core tools.

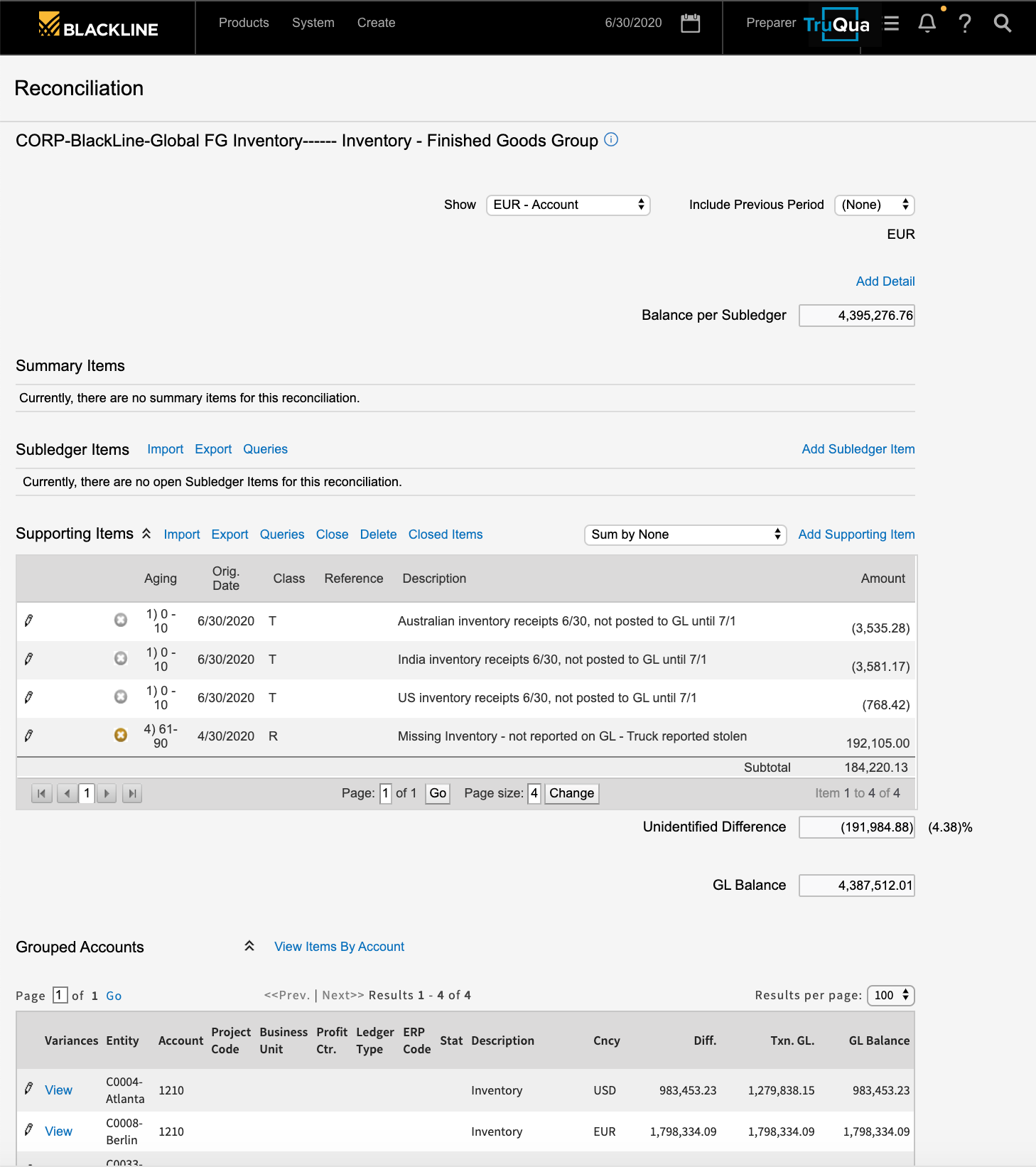

Through a platform that automates, centralizes and standardizes Account Reconciliations, BlackLine helps businesses create trust in the integrity of their financial statements.

About the Author:

Imran Lodhi is the Vice President of TruQua’s BlackLine Practice and an experienced FICO project leader. He is a financially disciplined, operationally-oriented and strategic leader with a track record of driving growth in complex, global organizations. Imran’s experiences include leading finance transformation through simplification and innovation, delivering better results with fewer resources, and bridging accounting, finance, and operations to increase margins whilst creating scalable processes.

For more information on the Financial Close or TruQua’s services and offerings, visit us online at www.truqua.com. You can also access our most recent Financial Closing webinar featuring TruQua’s Chief of Financial Solutions, Kirk Anderson and SAP Accounting and Financial Close Expert, Elizabeth Milne of SAP:

For more information on BlackLine, visit www.blackline.com and to be notified of future blog posts and be included on our email list, please complete the form below: