Improve Working Capital with SAP Receivables Management: A sneak peek at our upcoming webinar

Authored by Leo Schultz, SVP of Consultant Services, TruQua

The Digital CFO wants to reduce the risk exposure to the business of poor credit monitoring and inefficient collection standards. SAP’s Receivables Management integration with SAP’s sales order process – automatically performs credit checking to allow an order to be processed where tolerances allow, but creating workflow if tolerances are violated. SAP’s Receivables Management application also investigates collection rules as well as can apply cash automatically, providing an immediate impact on DSO thus improving working capital.

TruQua is pleased to announce our latest webinar “What’s new in SAP S/4HANA for Finance: Streamlining Receivables Management in SAP S/4HANA“, scheduled for Thursday, April 30th to showcases SAP Receivables ManagementThis blog features a sneak peek at a few of the enhancements our upcoming webinar will feature.

Key functionality delivered with SAP Receivables Management

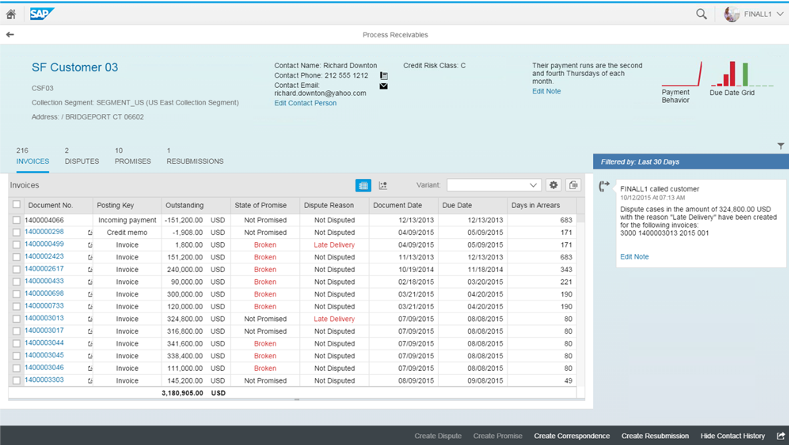

- Collection Management

- Manage disputes

- Create promises to pay

- Record customer interactions

- Leverage S/4 delivered analytics

- Credit Management

- Establish credit standards

- Automatically monitor customer credit

Business Benefits of SAP Receivables Management

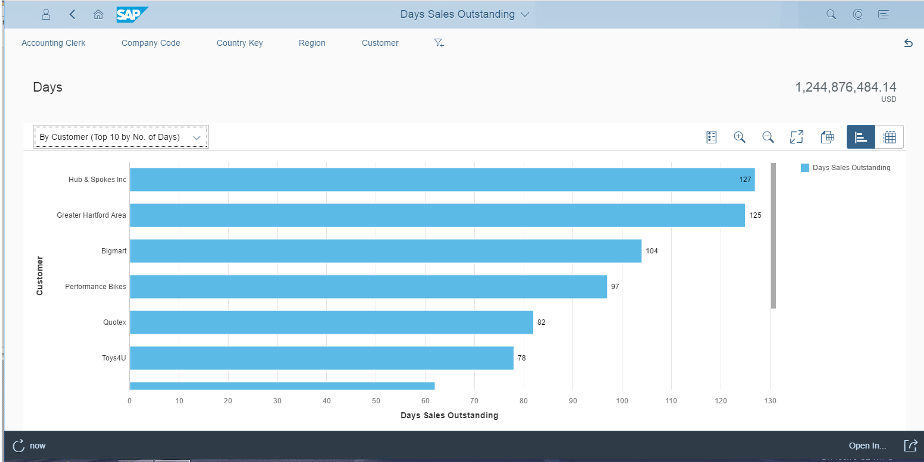

- Improve Working Capital – An important part of Working Capital management is minimizing Days Sales Outstanding (DSO). Using SAP, the Digital CFO can see live analytics of DSO and take immediate action.

- Leverage SAP Innovation – SAP Machine Learning innovations (Leonardo) help SAP customers leverage this innovative technology by automating the cash application process, which is historically a manually intensive process

- Efficiency Gains – Through reducing Days Sales Outstanding by 5-10%; Lowering Bad Debt Write-Offs by 10-20%; Lower the cost of Finance by 5-10%.

Register today for our upcoming webinar:

April 30, 2020: “What’s new in SAP S/4HANA for Finance: Streamlining Receivables Management in SAP S/4HANA”

About the Author

Leo P Schultz CPA, MBA, SVP of Consulting Services, TruQua

Leo has 10 years of SAP experience covering Financial Planning & Analysis including BPC and SAP Analytics in addition to his knowledge of SAP S/4HANA and Finance Transformation.