Digital Performance Management with SAP PaPM: How to get started

Authored by Marius Berner, Senior Consultant, TruQua

Introduction

Technology and software are deeply embedded in nearly every aspect of the modern business environment. In the era of “Big Data”, companies have access to more information than ever before, which creates not only a variety of opportunities but also brings about new challenges for companies that cannot keep up with the changing landscape.

Today, the ease with which the average person can access massive volumes of data and connect it in meaningful ways has increased exponentially from even ten years ago. This has opened up opportunities for smaller players to enter industries that may previously have had high barriers to entry, and in some cases allows these players to change the nature of the industry itself. An example of this can be seen by looking at the financial services industry.

With the rise of new “fin-tech” companies that have provided innovations in areas such as mobile payments, money transfer services, crowdfunding, and even alternate currencies, traditional providers have been pressured to provide comparable levels of simplicity and convenience within the consumer experience. With new levels of rapid, disruptive innovation prevalent in the market, enterprises must be willing to digitize their business model and reduce complexity wherever possible to provide the ideal experience for their customers and effectively compete.

This pressure to digitize business models warrants the need to examine new investments in innovation, which in turn can create new pressures on an organization’s profit margins. Because of this, it is more important than ever for large enterprises to constantly track and optimize product and service profitability through precise cost measurements. It is also critical for this profitability analysis to be as close to real-time as possible; with the rapid cycle for innovation introduced by today’s technology landscape, delays and “stale data” can expose companies to massive opportunity costs. This has created an increased need for “digital performance management” applications in many larger companies to rapidly adapt and respond to new opportunities and threats in today’s digital economy. One such option is SAP’s Profitability and Performance Management solution.

What is SAP PaPM?

The purpose of this blog series is to introduce and explore the functionality of SAP Profitability and Performance Management (PaPM), a cutting edge tool to help business users quickly design, maintain, and utilize powerful digital performance management applications to cut through the massive data volumes and gain immediate insights into managing the costs and profitability of their enterprise organization. PaPM gives users the ability to quickly configure solutions capable of sourcing and aggregating data from a variety of systems and databases, execute a variety of complex calculations down to low levels of granularity (tapping the power of SAP HANA’s in-memory data platform for optimal performance), and writing back the results to other applications (BW4HANA, BPC, S/4HANA, etc) for further processing.

Key benefits of implementing PaPM include:

- Role-based Fiori applications for packaging administrative, modeling, execution, and analysis tasks

- Guided function configurations allowing business users to build detailed, robust calculation and allocation models without complex coding

- Near real-time allocation of data from physical or virtual sources both on the local database or through remote connection to other databases, without requiring physical replication/persistence of the source data

- Built-in tracing functionality allowing business analysts full transparency into the cost allocation methodology and results down to the individual line item level

- Support to enhance models with flexibly defined simulation parameters for “what if” analyses

- Ability to post calculation/allocation results back to other applications – to the general ledger in S/4HANA, to planning data stores in SAP BPC, etc.

In addition to this introductory blog, this blog series will present focused examinations of critical topics in digital performance management including:

- Cost and Revenue Allocations in SAP PaPM

- Developing Cost Drivers in SAP PaPM

- Product Costing and Pricing in SAP PaPM

- Finance and Risk Modeling in SAP PaPM

- SAP PaPM as part of your integrated SAP landscape

Revenue and Cost Allocations in Digital Performance Management

When customers look to improve performance across their organizations, they need to ask questions about their business and the market they’re operating in to understand what is driving their bottom line profitability:

- What is our contribution margin by customer?

- Which products/services are most profitable?

- Which regions are we making the most money in?

- Which channels are the most effective for us to sell and distribute our products through?

- How should I view my overall cost and revenue distributions to understand which cost center/profit center managers are operating the most efficiently?

In addition to financial line items that can be directly associated with our desired analysis dimensions, organizations usually have indirect, fixed costs contributing to their bottom line profitability. In order to provide a complete picture of performance, organizations need to develop and execute allocations to collect these costs into pools and split them out to our lower level dimensions of analysis (product, customer, profit center, etc) based on some distribution basis defined by the business.

It’s often the case that allocations are one of the more computationally intensive processes performed in a business’s global systems; because of this, performance can often be a point of concern and something that organizations are looking to optimize. Additionally, it is critical to developing appropriate allocation drivers to determine how to split the costs in a way that makes sense for the business and how it operates; for this reason, a tool that makes it easier for end-users to iterate, simulate, and redesign their allocation models can provide a lot of value for digital performance management.

The Benefits of a Robust Finance and Risk Modeling Function

As mentioned in the introduction, the rapid movement of technology has necessitated that organizations consider new investments in innovation that may not have previously been part of their business models. In addition to diligently monitoring and optimizing their existing cost structures, it’s essential to monitor cash flows and positions to keep a pulse on the organization’s financial health (even more so if the organization is preparing to increase the speed and scope of new investments). It’s also useful to develop precise models for transfer pricing and movement of funds between different entities, as well as functions for valuation of current and potential investments to help understand the current and future state of the balance sheet.

When modeling and tracking increasingly complex finance and cash flow scenarios, it is important to anticipate and adapt for potential external and internal risk factors (currency fluctuations, new economic regulations, etc). Therefore, a truly effective digital performance management solution needs to be equipped with sufficient scenario modeling functionality to allow for planning not only the most likely scenario but also the best and worst-case scenarios.

Introducing SAP Profitability and Performance Management (PaPM)

With SAP Profitability and Performance Management (PaPM), SAP has provided a new generation of integrated performance management applications that can use and reuse existing data and information models from other SAP and non-SAP applications both in the cloud or on-premise. PaPM can also be seen as a next-generation successor to SAP’s PCM (Profitability and Cost Management) solution, which is no longer receiving new investment from SAP and is intended to sunset maintenance at the end of 2020. SAP PaPM allows users to rapidly build out robust, flexible calculation and allocation models, speeding up the timeline for proof of concepts and implementations and allowing the business to see faster returns on investment.

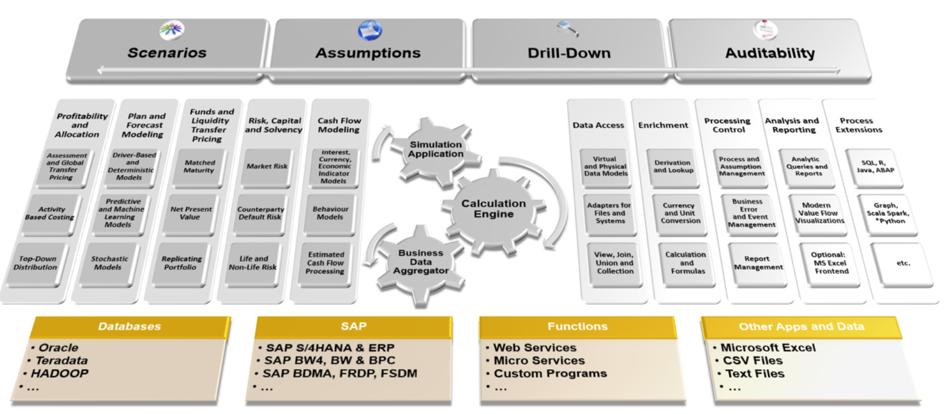

The functionality of SAP PaPM can ultimately be grouped and thought of as three components:

- Business Data Integrator – PaPM integrates with operational systems at high speed

- Calculation Engine – PaPM performs high-speed calculations for high volume data

- Simulation Application – PaPM provides real-time data insights with end-to-end traceability

Source: SAP

SAP PaPM as a Business Data Integrator

SAP Profitability and Performance Management comes with a variety of guided function types that enable the integration and aggregation of data from operational systems and data warehouses at high speeds, with little to no data replication required. The data can be accessed either locally (from within the same system as the PaPM installation) or remotely (from a separate system) through HANA Smart Data Access. In PaPM, read access to source data can be configured through on-the-fly SQL based access to database tables and views directly from the HANA database or from remote tables and views in other databases. If permanent network read access cannot be achieved for the desired source data, temporary data stores can be created to replicate data to provide permanent high-speed access for use in calculation models.

SAP PaPM delivers a variety of guided function types to support read and/or write access to both SAP and non-SAP data sources:

- Model View – data model function that allows read access to local and remote database tables and views

- Model Table – data model function which replicates and stores data in temporary SAP HANA tables to allow modification in PaPM without editing the source

- Model BW – data model function which allows users to define direct access to BW InfoProviders

- Model RDL – data model function that allows access to SAP HANA-optimized Result Data Layers of the Finance and Risk Data Platform

- File Adapter – provides automated access to files so that file content can be imported as input for calculations

- Remote Function Adapter – provides automated communication capabilities to other applications and systems so that they can be included in calculations and processes

- Query – reporting function that allows output and input of data

There are also a number of function types that can be used to group, reformat, and enrich the source data for easier utilization in calculations and modeling scenarios, including:

- Join – data access function to bring together the results of two or more other functions based on defined rules

- Derivation – data enrichment function that can be used to enhance the dataset with calculated attributes based on predefined rules at runtime

- Transfer Structure – data enrichment function that can be used to transpose data according to predefined condition fields and settings

- View – data access function that can be used to select data and provide projections and aggregations for consumption in other functions like allocation

After sourcing external data and processing it into the format required, we can build out powerful calculations and modeling scenarios in SAP PaPM to leverage the native power of the HANA engine.

SAP PaPM as a Calculation Engine

SAP Profitability and Performance Management allows business users to design and execute financial and business models by configuring and combining functions that can maintain and execute complex allocation, funds transfer pricing, valuation, and cash flow modeling as the data foundation for real-time, high-speed profitability and cost analysis.

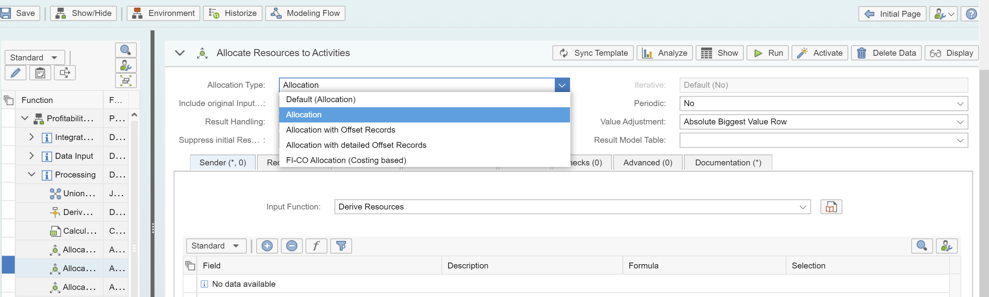

Allocation logic is a crucial component of an effective digital performance management application. Powered by SAP HANA, PaPM’s “Allocation” function type comes out of the box with guided configuration to walk users through setting up a wide range of common allocation parameters. This enables companies to flexibly maintain and execute complex models that perform near real-time allocations of massive volumes of granular transactional data, allowing organizations to analyze profitability by a wide variety of characteristics at a number of different levels (customer, product, contract).

Source: TruQua Internal Systems

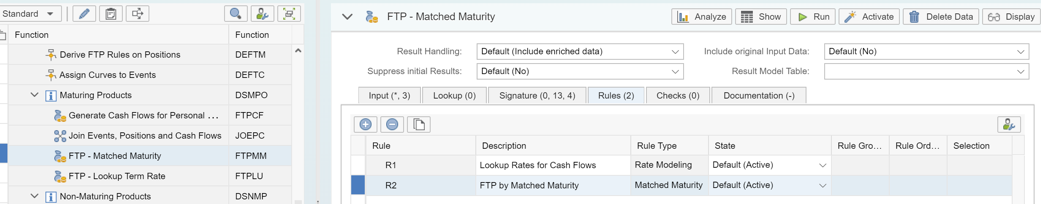

Additionally, since SAP PaPM was originally designed as a tool specific for the financial services industry (formerly branded as FS-PER: Performance Management for Financial Services), it also has packaged, guided function types designed to simplify traditionally complex functions such as Funds Transfer Pricing, Valuations, and Best Estimate Cash Flow (BECF) modeling.

Source: TruQua Internal Systems

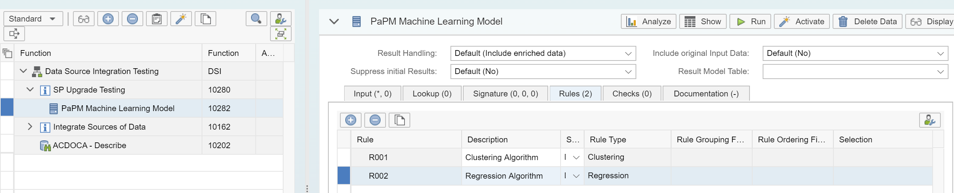

As of version 3.0 SP06, SAP PaPM also delivers basic predictive modeling through its “Machine Learning” function type, which guides users through selecting and running various algorithms such as regression or clustering.

Source: TruQua Internal Systems

SAP PaPM as a Simulation Application

In PaPM, the Environment is the top node of the Performance Management hierarchy: it is connected to a database in order to obtain all the necessary fields to be used and modified by the underlying functions Underneath an Environment, users can configure one or more Calculation Unit container functions to separate data and calculation models into representations of different financial or business units.

SAP PaPM roles are assigned based on the required access to the models represented in the individual Calculation Units:

- Users with the Modeling role can create, change, and delete calculation models (“Define” the model)

- Users with the Execution role can run functions in a calculation model, as well as change the values of certain parameters used for simulation and analysis (“Redefine” the model)

- Users with the Analysis role can use pre-configured reports to analyze results (“Use” the model)

Source: SAP

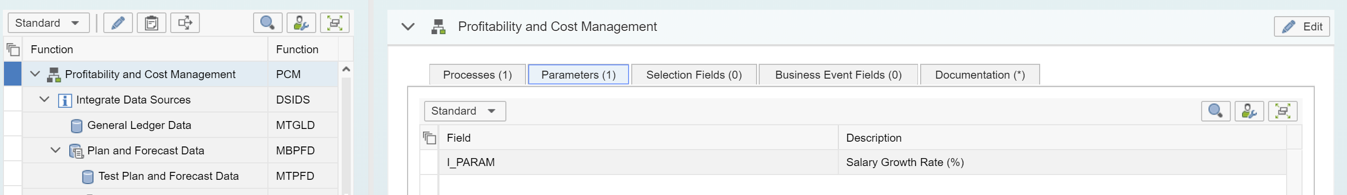

In addition to defining roles against the Calculation Unit, we can also create parameters and selection fields to influence the behavior of its contained functions at runtime. This allows us to run simulations on the fly while testing different values for a key driver or parameter, and could also be used to test our Machine Learning functions by simulating different test data sets through the predictive algorithm that was selected.

Source: TruQua Internal Systems

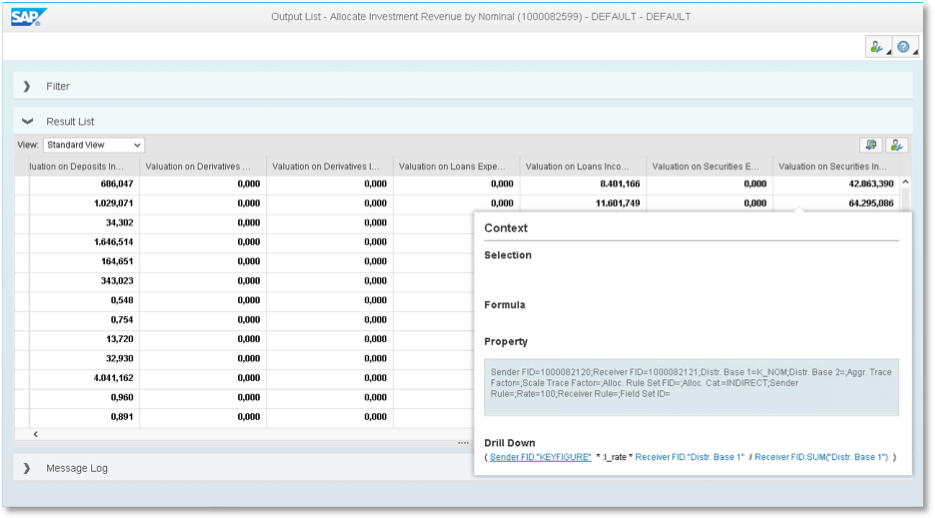

After executing or simulating function runs in PaPM, we are able to leverage built-in drill-down functionality to trace the results step by step back to the source.

Source: TruQua Internal Systems

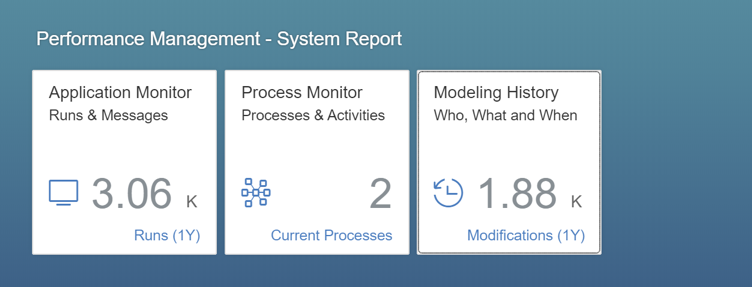

We can also use the library of Fiori applications provided to audit system tasks, data changes, and environment history.

Source: TruQua Internal Systems

Conclusion

In conclusion, SAP PaPM allows customers to build powerful performance management applications by providing:

- Real-time access to source data without the need for replication or additional persistence

- Full transparency of costs down to the individual line item level

- Flexible configuration and calculation capabilities that empower business users with minimal IT intervention

- Powerful iterative configuration to allow real-time testing, adjustment, and simulation of modeling scenarios

With these capabilities as well as SAP’s continued investment in the product’s integration and write-back capabilities, PaPM will only grow to be more effective as a tool to help companies analyze and control their costs and profit margins. We will dig deeper into various aspects of the functionality PaPM provides in the subsequent posts in this blog series.

About the Author

Marius Berner is a senior consultant at TruQua Enterprises with more than five years of experience implementing and designing SAP analytics solutions across multiple industries. He has worked on projects ranging from end-to-end implementations, landscape transformations, business/finance transformations, and process optimizations. Marius has written additional posts on the topic of SAP PAPM and has recently authored an E-book on Introducing SAP BPC for SAP S/4HANA.