2022 Central Finance Exchange: Customer Insights

TruQua recently participated, along with Magnitude and SAP, in the 2022 Central Finance Exchange. The event brought together finance and IT executives from over 50 companies to discuss best practices, lessons learned, future plans, and to get an update on the Central Finance roadmap.

Prior to the event, SAP collected information from these companies, via a survey, to understand their objectives, business priorities, planned solution implementations, their current landscape, and more.

Figure 1: Industries represented in survey

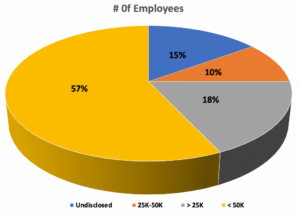

Figure 2: Number of employees at each organization represented in survey

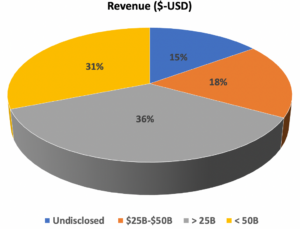

Figure 3: Company revenue of organizations in survey

Company Profiles

There were 15 different industries represented at this year’s event, with manufacturing (60%) representing the largest number of participants.

36% of participants in the benchmarking survey represented companies with revenue from $25-$50B, 31% represented greater than $50B, 18% were in the less than $25B category, and 15% did not disclose.

18% of participants have 0-25K employees, another 10% have 25-50K employees, 57% have greater than +50,000 employees, and 15% did not disclose.

Figure 4: Number of SAP systems and Live SAP Systems by organization

26% have 10+ SAP systems, another 38% have 5-10 SAP systems, and the remaining 36% have 0-4 SAP systems.

36% of the respondents have 0-4 live SAP systems, 33% have 5-10 live SAP systems and 31% have 10+ live SAP systems. 86% of the customers has non-SAP systems which are part of their Central Finance Project.

Priorities & Goals

Figure 5: SAP Central Finance Business Priorities (2019/2020/2022)

Survey participants were also asked to list their business priorities. These included, Transparency & Accountability (85%), Speed & Efficiency (28%), Operating Costs & Productivity (64%), Strategy/Planning to Execution (26%), Service Level (18%) and Shared Service Model (49%).

As you can see above, business priorities have shifted some from year-to-year. For 2022, the clear focus from a business perspective is transparency & accountability and operating costs & productivity where in 2019 the business focus was strongly on speed & efficiency.

Figure 6: SAP Central Finance Goals (2019-2022)

In addition, participants shared their goals as they pertain to Central Finance. These goals included, finance/business transformation (67%), Central Finance as a steppingstone to S/4 (37%), process centralization (55%), merger & acquisition (37%), post-merger integration (0%), and centralization process automation/machine learning (18%).

Like the business goals, there has been a shift in central finance goals but, finance/business transformation has continuously been the top goal pertaining to Central Finance. For 2022, process centralization and process automation is the main goal for Central Finance customers. This is complementary with the newest Central Finance product features which have strong focus on Central Processes.

Target Processes

Figure 7: Solution Target Processes: Record to Report

As it pertains to solution target processes – record to report, financial reporting, and management reporting were the most targeted at 92%, with general ledger accounting at 74%, entity close and group reporting/group close came in at 67%, and account substantiation and reconciliation had 49%.

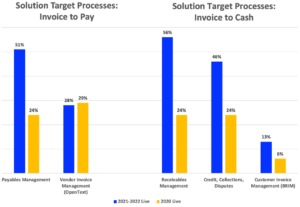

Figure 8: Solution Target Processes: Invoice to Pay and Invoice to Cash

In regards to solution target processes – invoice to pay, payables management was the most targeted at 51% and vendor invoice management came in at 28%.

Solution target processes – invoice to cash, receivables management was the most targeted at 56%, followed by credit, collections, disputes at 46%, and customer invoice management at 13%.

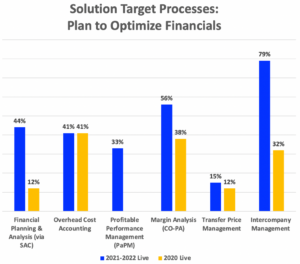

Figure 9: Solution Target Processes: Plan to Optimize Financials

Solution targeted processes – plan to optimize financials, intercompany management was the most planned solution at 79%. Margin analysis was next at 56%, followed by financial planning & analysis (via SAC) at 44%, then overhead cost accounting at 41%, followed by Profitability/Performance Management (PaPM) at 33%.

Key Learnings

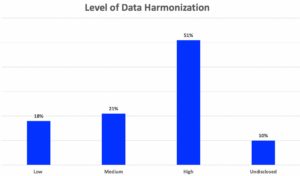

Figure 10: Level of Data Harmonization

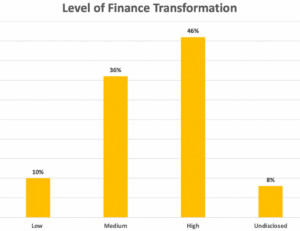

Figure 11: Level of Finance Transformation

As it pertains to project data, 51% say they have a high data harmonization level, 21% are at medium, and 18% say they have a low data harmonization level. 10% is undisclosed.

46% of survey respondents have a high finance transformation level, 36% are at medium, 10% have a low finance transformation level, ad 8% were undisclosed.

Conclusion

This was the first in person Central Finance Exchange event in two years. Everyone was very excited to attend in person. The participation was excellent, the presentations shared were invaluable and the interactive discussions and connections made are irreplaceable. We are already looking forward to the 2023 event!

For the latest information and updates on SAP Central Finance, contact the TruQua team today at truqua@us.ibm.com.